China is known worldwide as the workshop of the West. But for many years, it has no longer only been known for its extreme production capacity. It exceeds repeatedly the superlatives in all the statistics and rankings, and the digital world is no exception.

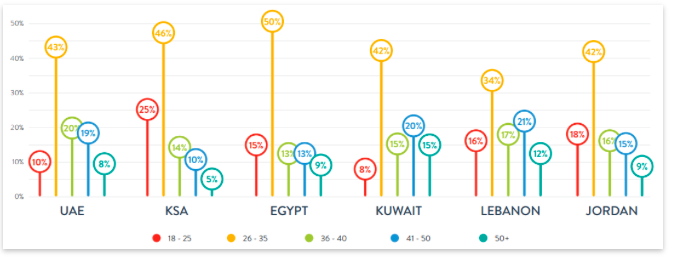

Currently of the Chinese total population of 1,362,000 inhabitants, more than 600 million are already online, which is an Internet penetration rate of almost 50 per cent. It makes up 22 per cent of global internet users (1) in one country, and over 95 per cent have one or more social media accounts (2) which they also actively use, on average around 1.7 hours/day of intensive use (3), making China the undisputed social media giant.

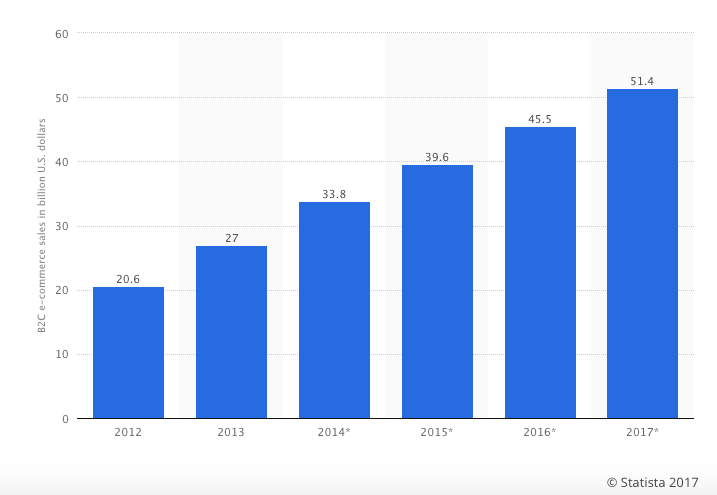

But those are not all the superlatives. China has managed, in less than 15 years, to become the world’s second largest eTail market and become a global leader in online sales of luxury goods, which is reflected in an annual turnover from online sales of 2.9 trillion (2014). (4) And the market, seemingly unrestrained, continues to grow. Alone in the first quarter of 2015, online shopping sales once again increased by 45.2 per cent compared to last year, with an increase of 169.3 per cent (5) in mobile shopping. Recent forecasts even expect 2015 to be a turning point in B2C eCommerce with mobile becoming the dominant e-shopping channel.

Impressive figures – impressive results. Results that have attracted worldwide attention and interest in understanding the Chinese digital revolution phenomenon.

In recent years much has been written about the digital and mobile ecosystem in China, making the three Chinese Internet giants, Baidu, Alibaba and Tencent, familiar to marketers worldwide. Three companies and the three corporate visionaries behind them, Robin Li (Baidu), Jack Ma (Alibaba) and Huateng “Pony” Ma (Tencent), whose significant contributions to the digital revolution in China and China’s digital market resulted in the BAT Ecosystem (Baidu / Alibaba / Tencent). An ecosystem that has catapulted the three men not only to the forefront of digital China, but also to the top of the Forbes list of the richest Chinese.

To be a successful company in China, whether B2C or B2B, consumer or luxury goods, it is necessary be present online and to be part of this ecosystem, and this in a way which is relevant to the Chinese audience. And it needs to be understood that what is familiar and successful in the Western world is not necessarily the solution in the Far East. To succeed, an understanding of the culture, as well as the digital environment is indispensable, and not just in terms of language. An adaptation to modern Chinese lifestyle is essential and in 2015 that means: social media, eCommerce and mobile.

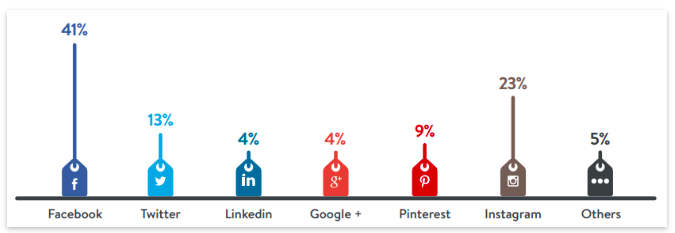

The Chinese rely on social media more than any other (marketing) channels, because social media channels provide an opportunity to express and exchange their views in ways not possible in other, largely government controlled, channels. Through their experience with the government, the Chinese attach great importance to the opinions of other Chinese. Recommendations from friends, from family or from business partners are in great demand. More than 66 per cent of all Chinese trust and rely on their friends, especially when it comes to buying or investment recommendations. Moreover, instant messaging systems in eCommerce provide direct and immediate contact with the customer, which can significantly increase trust and influence on the customer. The interaction in social channels between users, with KOL (Key Opinion Leaders), as well as brands, can therefore take place directly at a different level and specifically affect decisions. This means that there is nowhere worldwide with more social media addicts.

Since most Western social networks (Pinterest, Facebook, Google+, Twitter and YouTube) are blocked in China, and are difficult to reach reliably via VPN tunnel, a separate national social network has evolved over the past few years, based on the central platforms Sina Weibo and Tencent’s We chat. A social marketing network has emerged which many experts consider better, and from the marketing perspective allowing more targeted, efficient marketing measures than is the case in Western media.

With regard to e-commerce the Chinese government’s last 5-year plan (2011-2015) set a clear objective: China as a global leader in eCommerce. This was centralized and energetically launched. Government action ranged from simplified processes in the creation of eCommerce companies, including tax breaks, a significant improvement of Internet and mobile networks (4G), as well as logistics, through to innovative payment arrangements. And the goal was achieved. Chinese consumers bought more online than ever before, and the aforementioned incredible figures prove that. But again, only those who understand how the giants, Alibaba (B2B), Taobao (C2C) & Tmall (B2C), function can be successful here.

But what now makes the Chinese market so different to the rest of the world? How do these superlatives come about? And above all: how can we use these opportunities?

In a recent interview, Jack Ma, founder of Alibaba, put it in a nutshell: “In other countries eCommerce is a way to shop, in China it is a lifestyle” – and that’s exactly how eCommerce in China differs from the rest of the world.

And what applies to eCommerce also applies to other digital measures. The phenomenon in China is not the figures as such, impressively as they are, but the fact that “online” is “integrated” into the lives of 1.3 billion Chinese people, and that it is an indispensable normality – daily business.

Marketing in China can therefore only be successful if “digital” is also a matter of course, a part of everyday life. The Chinese live on the Internet; the Internet is a part of their lives. Therefore: digital channels have to be essential parts of everyday life – via desktop, tabloid, smart phone, QRCode, social media, KOL, instant messaging, Alipay etc. Every conceivable digital measure must be considered and used whenever possible in order to integrate a company and its brand into Chinese consumer’s lives.

And this is a challenge which in many cases the German/European/American headquarters cannot master in the launch of Western brands in China.

The approach “we have a marketing concept and we’ll roll it out worldwide” may work well in conditions found in many European countries or the United States. China, however, requires a different approach. In China “digital” is not just a marketing channel; it is the heart of marketing. The point where all the strands converge. Almost no campaigns come without a focus on digital. The majority of media plans for China are limited almost exclusively to digital channels to the surprise of European colleagues – and when in the exception Offline is considered, this is only part of a well thought of Offline-to-Online (and vice versa) mechanism that is the key to success here.

The seamless integration of both worlds is no longer theory but practice, which is confirmed in China, and accounts for the investments of Chinese technology companies such as Baidu, Sina and Tencent in retail business and offline business models, as increasingly highlighted in the media.

Social media has taken the key role in successful campaigns in modern China.

At a time when (from the Chinese perspective completely outdated) social media in the Western world is celebrated as the great innovation in customer communications and user dialogue – social media in China already provides all-purpose instruments and a central campaign framework and already offers, alongside marketing, a direct shopping channel, payment terminal and shipping tracking in a single application in the hands of the buyer.

And that is not the end of it. Almost every week China’s digital players put new innovations and technology into the race, which are then adopted in the shortest time and integrated into daily life by an extremely inquisitive open-minded society, eager for innovation and technical highlights,. Innovations often need months if not years to find widespread recognition in the Western world, whilst in China they spread at a record rate across all age and income groups.

But China is not only a market of giants. In addition to the known, previously mentioned players, there is still plenty of space for thousands of niche players (which often have more than 500,000 active users) who, through innovation and customer focus, satisfy the still unsatisfied hunger of Early Adapters. The need for the integration of digital applications in daily life is immeasurable and so there are now digital gadgets available for every imaginable need – which often make life much easier. It is already normal to pay at vending machines with a smart phone, and in daily life, the use of taxis or bill payment without apps and with cash is almost impossible – or at least considered obsolete and primitive.

Applications like QR Code or ibeacon, which in Germany are found at most as gimmicks in technology fairs or as a guide in innovative museums, are in China’s 1st and 2nd Tier cities essential instruments to ensure communication between advertisers and their consumers.

For those involved in advertising and sales, these developments are, in many respects, a challenge. If it is already a challenge to keep up-to-date with these new features, then the second step is to successfully use these new innovations and know how to integrate them accordingly in the communication mix as well as in sales and distribution processes. An outstanding example of this is the development of WeChat with regard to virtual money transactions as well as the use of smart phones as the dominant eCommerce channel of the future.

However, these developments present Western companies in particular often unexpected obstacles. To get an overview and find the right approach often involves high unplanned costs for highly localized communication and distribution concepts as well as the corresponding implementation itself. This often leads to global campaigns being locally adapted with only limited budgets and then often with limited success. However, anyone who is willing to invest and exploit the potential of the Chinese digital playing field is rewarded, and the Western brands which have taken a local approach are rewarded with surprisingly strong market positions.

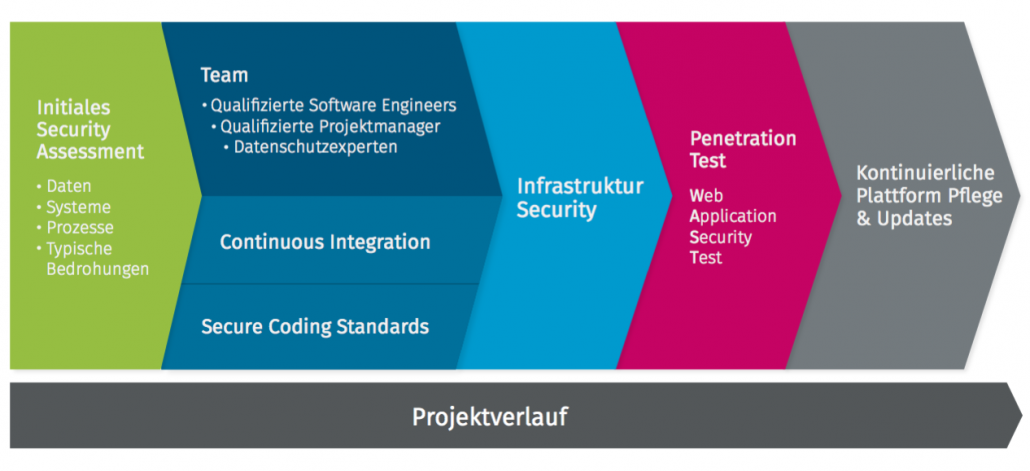

The secret to success here is usually a strong local team with the right local partners, openness to new technologies and to some extent for the West completely unknown players and platforms, as well as anticipating a corresponding flexibility in the implementation, especially when it comes to global guidelines, IT standards and consent. Here, the Western world too often lags behind developments in the Far East, and time plays a very important role in China. China is in constant change and development, and is clearly ahead of the West in many areas. In particular, the digital environment is developing rapidly and requires of all who want to be involved successfully, the highest speed.

True to the mantra of the Digital Experts in China: “Execute fast, or die.”

(1) http://www.internetlivestats.com/internet-users/china/

(2) which explains why the number of social media users exceeds the number of Internet users

(3) Source: NBS of China, CNNIC, Tencent, MIIT of China, Global Webindex: wearesocial.com;

(4) http://www.iresearchchina.com/views/6484.html;

(5) http://www.iresearchchina.com/views/6484.html; http://www.iresearchchina.com/views/6449.html